[ad_1]

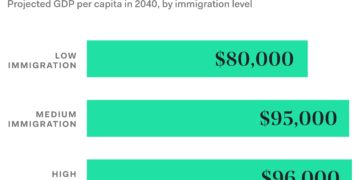

New analysis performed by Progressive Assume Tank Keystone Analysis Middle, introduced in Could, revealed that naturalizing undocumented immigrants in Pennsylvania would considerably profit the state’s price range. Pennsylvania is dwelling to 900,000 people who’ve an immigrant background, accounting for 7% of Pennsylvania’s inhabitants. Amongst them, 160,000 are undocumented.

Naturalizing Undocumented Immigrants

Muhammed Maisum Murtaza of the Keystone Analysis Middle performed the research, known as – “The financial contribution of Pennsylvania immigrants.” The survey revealed that Pennsylvania employs 94,000 undocumented immigrants. The Middle, analyzing information from a survey performed by the Institute for Tax and Financial Coverage in 2017, discovered that undocumented immigrants account for practically $135 million in state and native taxes. If these immigrants grew to become U.S. residents, the tax funds would have elevated by $51 million for higher-paying jobs main to higher alternatives for tax submitting.

“Immigration-friendly insurance policies aren’t nearly financial justice. They may strengthen and increase the contributions immigrants make to the Pennsylvania economic system and profit everybody,” the research stated. Murtaza’s analysis divided Pennsylvania into three classes: labor contributions, financial and tax-based contributions, and non-tax or buying energy contributions akin to tutorial background and entrepreneurial affect.

Labor Contributions

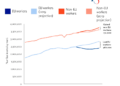

Underneath labor contributions, the survey confirmed that 9% of Pennsylvania’s front-line employees are foreign-born, 9% belong to the truck/warehousing business, and 19% are constructing cleaners. The final three a long time have seen a considerable enhance within the variety of certified immigrants from 53% in 1990 to 67% in 2019. This accounts for a rise of 850,000 immigrants.

Financial Tax-Primarily based Contributions

The research targeted on financial and tax-based contributions, family revenue, and spending patterns for Pennsylvania immigrants. The survey discovered that foreign-born residents paid a complete of $10 billion, state, native, and federal taxes for the 12 months 2019. “Pennsylvania’s whole buying energy is about $25 billion and whole family revenue is $35 billion.” Based on the survey, foreign-born residents can have paid practically $10 billion in state, native, and federal taxes in 2019.

Based on the New American Economic system, within the Pittsburgh area alone, immigrants pay $1.2 billion in taxes, family revenue is $ 3.8 billion, and buying energy is $ 2.7 billion.

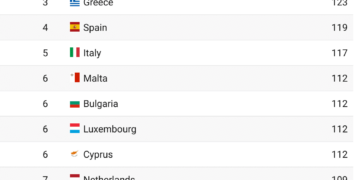

International-Primarily based People Have Greater Commencement Charges

Additional, research present that foreign-born people have greater charges of bachelor’s levels and graduate levels when in comparison with U.S.-born people. In truth, Pittsburgh has the very best charge of educated immigrants of any metropolis in america. The research confirmed that in 2019, whereas 20% of foreign-born people earned a graduate diploma, solely 12% of U.S.-born people did so.

Undocumented Immigrants Stay Hopeful

The research reveals that immigrants have skilled thriving instructional and financial, growth, regardless of having little or no assist from the U.S. authorities. Aside from lawful everlasting residents, most documented and undocumented immigrants are ineligible for monetary help. For instance, undocumented immigrants didn’t obtain stimulus checks underneath the American Rescue Program and usually are not eligible for federal schooling loans.

President Biden has despatched a invoice to Congress searching for a significant revamp to the immigration system, together with an eight-year path to citizenship for an estimated 10.5 million undocumented immigrants together with different insurance policies. Immigrants are ready to see if any of the reforms talked about within the invoice turn out to be regulation.

To be taught extra about this weblog publish or in case you have every other immigration considerations, please be happy to contact me at rglahoud@norris-law.com or (484) 544-0022.

[ad_2]

Source link

![[5] Elysian EMPIRE?! | EU4 Third Odyssey | Elysia](https://198immigrationnews.com/wp-content/uploads/2021/10/1634740868_maxresdefault-120x86.jpg)